The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided an opportunity for employers to generate a refundable tax credit used to offset their employment taxes and apply for a refund for any excess credit generated through December 31, 2020.

The COVID-19-related Tax Relief Act of 2020 further extended the Employee Retention Tax Credit (ERTC) through June 30, 2021. It included certain enhancements that applied starting January 1, 2021.

Then, in March 2021, the American Rescue Plan Act (ARPA) was signed by President Joe Biden—further extending the ERTC through the end of 2021.

Employee Retention Tax Credit Update

In November 2021, the Infrastructure Investment and Jobs Act (IIJA) was signed by President Biden, retroactively terminating the ERTC for the fourth quarter of 2021. This limited the availability of ERTC to qualified periods between March 13, 2020, through September 30, 2021.

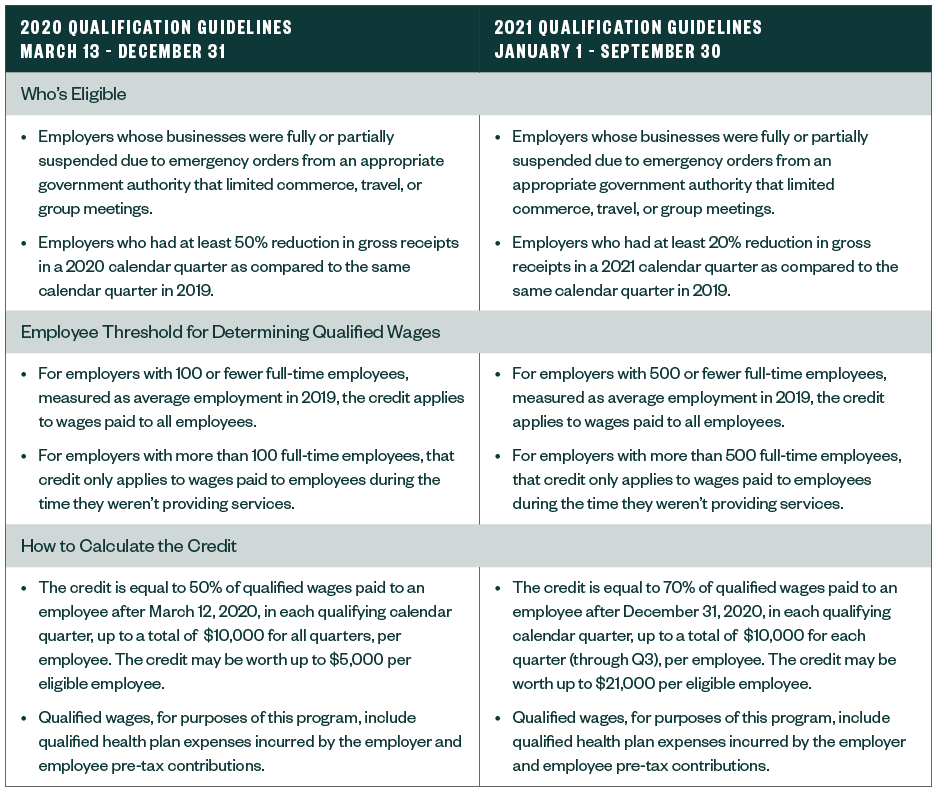

Below are details about how employers could qualify as well as eligibility requirements.

ERTC Eligibility and Guidelines

What changes are in the ARPA and IIJA of 2021?

The ARPA includes revisions to the ERTC that apply exclusively to the third and fourth quarters of 2021. One change, for example, specifies that the credit will be applied against an employer’s share of Medicare taxes instead of Social Security taxes. Excess credits will remain refundable.

What is the ERTC qualification period end?

The IIJA retroactively terminated the qualified period for the ERTC to September 30, 2021.

However, businesses that qualify as recovery start-up businesses may continue to claim the ERTC through December 31, 2021. Additionally, employers may still amend returns to apply for the ERTC for all qualified periods.

Recovery Start-Up Businesses

The ARPA establishes a new option for eligibility, widening the number of employers who can qualify for the ERTC to include recovery start-up businesses.

A recovery start-up business generally is an employer that meets the following criteria:

- Started operating after February 15, 2020

- Has average annual gross receipts of less than or equal to $1 million

Employers that meet this definition may claim the credit without suspended operations or a reduction in gross receipts. However, the refund amount is limited to $50,000 total per employer, per quarter.

Additional Relief for Severely Financially Distressed Employers

The ARPA provides another relief opportunity for severely financially distressed employers, which are defined as those that have less than 10% of gross receipts for any of the first three quarters of 2021 when compared to the same quarter in 2019.

Qualifying employers, regardless of size, can count any wages paid to an employee during a qualified calendar quarter as qualified wages.

Guidance on Partial Suspension of Operations

The IRS previously stated that “more than a nominal portion” of operations had to have been suspended for an employer to qualify as having their operations partially suspended due to a COVID-19-related government order. However, initially there was no guidance issued to help employers determine what a more than nominal portion meant or how to measure it.

The IRS issued further ERTC guidance, specific to 2020, in Notice 2021-20. The notice states that an employer’s suspended operations meet the “more than nominal” definition to qualify for the ERTC when any one of the following statements is true:

- Gross receipts from the suspended operations comprise at least 10% of total gross receipts

- Hours of service performed by employees in the suspended operations account for at least 10% of total service hours

- Changes to operations result in a reduction of at least 10% of the employer’s ability to provide goods or services

How does the ERTC affect the Paycheck Protection Program?

The Tax Relief Act of 2020 retroactively waived the exception for Paycheck Protection Program (PPP) loan recipients to also claim the ERTC.

A business or affiliates of a business who received a PPP loan may go back and claim the ERTC to the extent the business was experiencing a partial suspension of operations—or if they met the 50% reduction in gross receipts test—for the eligible calendar quarters in 2020.

PPP recipients may also qualify during the eligible 2021 quarters if they continue to experience a partial suspension of operations or meet the 20% reduction in gross receipts test.

Qualified wages for the ERTC don’t include wages paid from forgiven PPP proceeds.

How do organizations retroactively claim the ERTC with Form 941-X?

Employers who didn’t claim the ERTC on their originally filed IRS Forms 941 may retroactively claim the credit by filing IRS Form 941-X.

The same wages used to calculate the ERTC can’t be used to calculate other credits, such as:

- Work Opportunity Tax Credit

- Employer Paid Family and Medical Leave Credit (IRC 45S)

- Other disaster retention credits

- R&D credits

Additionally, qualified wages don’t include wages paid from certain grants under the Small Business Association or from the new restaurant revitalization grant.

Employers have three years from the date the original return was filed, or two years from the date the taxes were paid, to file an IRS Form 941-X.

We’re Here to Help

If you have questions about these credits, would like assistance in determining if your business is eligible, or help calculating or claiming the credit, please contact your Moss Adams professional.